Línea Directa´s premium income grew 3.6% in the first half of the year to 492 million euros

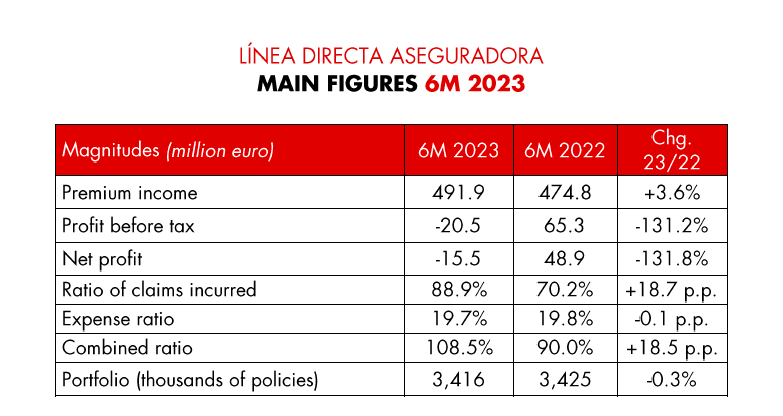

- Línea Directa Aseguradora's premium income increased by 3.6% in the first half of 2023 compared to the same period of the previous year, to 491.9 million euros, thanks to the increase in turnover in all lines (Motor, Home and Health).

- Premiums written, which are recorded in the statement of profit and loss with a 12-month lag, rose by 4.6%, the highest growth rate in four years. This upward trend is the result of the company's strategy to gradually recover the technical margin, which includes prudent risk underwriting and prioritising profitable growth over volume.

- “We are applying all the necessary measures in an inflationary situation like the current one, which we already anticipate would be complex. We are hardening the subscription, adjusting the premiums to the risk of each client and making the management of claims more efficient. All this will make us come out stronger in order to take advantage of the opportunities that the change of cycle will bring”, Patricia Ayuela, CEO of Línea Directa Aseguradora, said.

- Strict control of overhead expenses and progress in the company's efficiency plan enabled Línea Directa to reduce its gross operating expenses by 4% in the first half of the year. The company's expense ratio thus fell to 19.7%, one of the best in the sector.

- The combined ratio stood at 108.5% due to the impact of persistent inflation in service costs. As a result of this, the Group's net attributable profit for the first six months of 2023 was negative, at 15.5 million euros.

- Línea Directa Aseguradora maintains a solid and quality balance sheet: The bank's solvency margin reached 186% at the end of June, 3.1 percentage points more than in the first quarter of the year.

Madrid, 21 July 2023. Línea Directa Aseguradora closed the first half of the year with premium income of 491.9 million euros, 3.6% more than in the same period of 2022, thanks to the growth in turnover in all its lines of business (Motor, Home and Health).

Meanwhile, the company recorded a net loss of 15.5 million euros as a result of the impact of the persistent inflation of service costs, which continues to affect margins in the insurance sector, especially in the Motor line.

The company's policyholder portfolio stood at 3.47 million customers at the end of June, a slight decrease (-0.3%) which was fully offset by the improvement in turnover. It is also fully aligned with the action plan announced at the Annual General Meeting by the CEO, whereby the company is applying prudent underwriting, prioritising profitable growth over volume, and applying an individualised fee adjustment according to the risk of each customer in the current inflationary scenario.

In this regard, premiums written, which are effectively recognised in the statement of profit and loss with a 12-month lag, increased by 4.6% in the first half of 2023. This is the highest growth in earned premiums for the Group in four years, since the first half of 2019.

Income growth across all lines of business

By line of business, Línea Directa's revenues in Motor exceeded 396 million euros, up 3.4%, making a string of six consecutive quarters of improved turnover, and the customer portfolio stood at 2.56 million policyholders (-0.8%).

Home, despite the pressure of the increase in official interest rates on the property market, grew by 1.2% in the number of customers, to 746,000 policyholders, and increased premium income by 5% to 75.3 million euros.

Vivaz, Línea Directa Aseguradora's health insurance brand, recorded an improvement in premium income of 5.1% to 19.8 million euros, in a context of slower growth in the sector due to the current economic cycle. Vivaz also grew by 1.6% in health policies, to 108,000 policyholders, leveraged on a prudent strategy of risk selection.

From a commercial point of view, and within the framework of the company's action plan, Línea Directa is driving innovation in products, services and commercial efficiency and effectiveness to help accelerate cross-selling, diversification and profitable growth.

During the first six months of 2023, the Group launched commercial innovations such as "Motor + Home Formula", the first step by an insurer in Spain towards the convergence of policies; "Mortgage Free", a Home policy with special conditions for customers who have finished paying their mortgage, and "Carefree Home", the first Home insurance with full coverage against squatting. This has already allowed Línea Directa to consolidate its brand as the most notorious in the Spanish insurance market and to increase demand by more than 20% in the first half of the year.

Discipline in expenses and improvement of operational efficiency

Línea Directa continued to show a good performance in controlling overhead expenses. Gross operating expenses were down 4% year-on-year in the first half, and 7% in the second quarter alone. As a result of this, the company closed June with an expense ratio of 19.7% (-0.1 p.p.), one of the best in the sector. In the second quarter alone, this indicator fell to 18.3%, 3.9 p.p. lower than at the end of 2022.

This positive performance was due in part to the constant discipline in the company's overhead expenses and in part to the progress made in the optimisation and digitalisation of internal processes and services as a result of the efficiency plan launched last year.

The company has already begun to apply Artificial Intelligence in operations such as the opening of claims, simplifying them and making them more agile. The digitalisation of services has also reached record levels: more than 87% of customers are digital, more than 56% of car insurance claims and towing requests being handled through digital channels, and 46.5% of home insurance claims are opened in this way. This is resulting in an increase in productivity, such that the volume of premiums per employee rose by 7.5% in the first half of the year.

Impact of cost inflation on margins and net profit and loss

The Group's ratio of claims incurred stood at 88.9% (+18.7 p.p.) and the combined ratio at 108.5% (+18.5 p.p.), primarily due to persistent inflation which continues to cause a sharp increase in repair and replacement costs in Motor, the largest line of business in Línea Directa Aseguradora's accounts. This is in addition to the 8.5% increase in the injury scale for this year, which is on top of the 4.1% increase in 2022. This has led to higher spending on personal injury compensation for traffic accidents.

This has affected Línea Directa's insurance result in the first six months of 2023. The company's financial result amounted to 16.9 million euros (-7.9%), 2.6% more excluding capital gains. Thus, the Línea Directa Group has registered a net loss of 15.5 million euros in the first half of 2023.

The company, as part of its action plan, is already implementing measures to optimise claims management and contain the cost of claims. This, together with the rigor in the selection and underwriting of risks, are the two main levers already activated by the company to compensate for this effect of inflation on delivery costs.

In any case, the company strengthened its solvency margin to 186% in the second quarter, 3.1 percentage points more than at the end of the first three months of the year. In this way, it maintains a solid balance sheet made up entirely of tier 1 or top-quality capital.

In the words of Patricia Ayuela, CEO of Línea Directa Aseguradora, "we are applying all the necessary measures in an inflationary situation like the current one, which we already anticipate would be complex. We are hardening the subscription, adjusting the premiums to the risk of each client and making the management of claims more efficient. All this will make us come out stronger in order to take advantage of the opportunities that the change of cycle will bring. Cost inflation, although showing early signs of slowing down, has consolidated at high levels and continues to affect the margins of the sector as a whole and, temporarily, Línea Directa's results. Regardless, in the first six months of the year we have demonstrated our ability to grow profitably in revenue and operate with increasing efficiency”.